Determining your portfolio goals and your risk tolerance is the first step in creating an investment strategy. The next step is to deploy the investment strategy by mapping out an asset allocation. This is the mix of asset classes and the corresponding individual stocks and bonds, investment funds or instruments that you will invest in.

When you work with an investment advisor, this process can be uniquely tailored to your goals and risk tolerance. It will include a long-term plan as well as a series of smaller tactical shifts that are meant to help the portfolio meet return goals while staying within risk parameters.

Key concepts we’ll cover: Strategic Allocation, Tactical Allocation

The Strategic Allocation

The “Strategic Asset Allocation” represents the portfolio’s relatively long-term goals and risk tolerance and is usually planned to map to a given stage of the business cycle, which can last for 5-10 years. As long as the economy and the markets remain stable, rebalancing to ensure that the portfolio remains within the strategic allocation as asset prices change over time is usually done annually.

The strategic allocation begins with deciding what your return objectives and risk tolerance are and selecting a portfolio that overall will work to achieve your desired return without exceeding your risk tolerance.

This is expressed as a percentage of bonds, stocks, and cash. By having investments that react differently to the same market conditions, the expectation is that all positions in a portfolio will not be up or down at the same time. Over the investment horizon, poor returns in one asset may be offset by good returns in another.

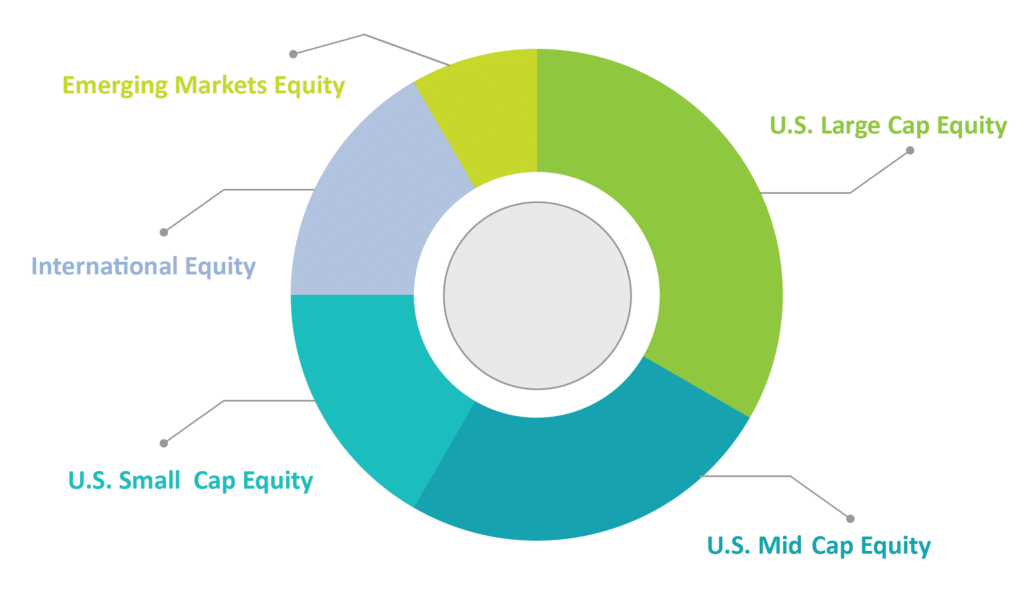

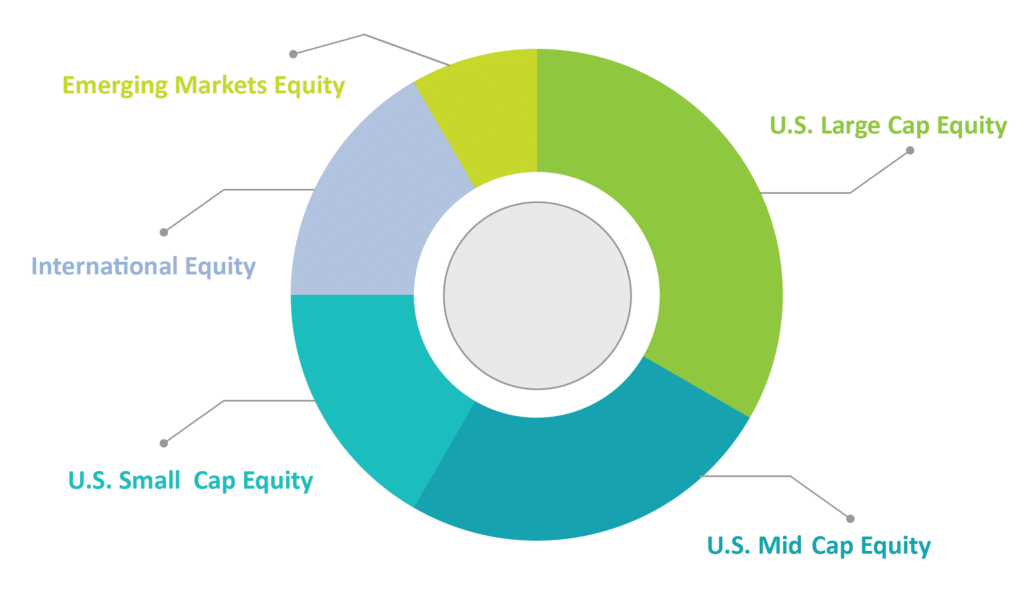

For purposes of illustration, we’ll look at a “moderate” risk portfolio – one that combines 60% equities, and 40% fixed income. Within each asset class, the investments are further spread amongst sub-asset classes that provide additional diversification, across different geographies or other characteristics. Each of these investments is given a desired weighting in the portfolio based on its risk/return expectations, and a benchmark is determined for each.

For example, the equity portion of the 60/40 portfolio wouldn’t just be invested in one stock or even one sub-asset class of stocks, such as Large Caps. It would be split among several, and might look like this:

The largest holding is U.S. Large Cap Equity, but Mid Cap, Small Caps, International and Emerging Markets all have a role to play in creating a portfolio that can be managed towards a desired return/risk profile.

Tactics Can Add Value

While the strategic allocation remains static, markets move all the time, driven by economics, technological innovation, geopolitics and a host of other variables. These moves can create opportunities for return that are missed by the broader allocation. Adjusting long-term target portfolio weightings for a short period of time to capitalize on these types of opportunities, and then resetting to the target weights is called the Tactical Asset Allocation.

A Short-Term Play

This sounds complicated, but it just means shifting money from one investment to another, depending on what is likely to generate the best performance in the short term. In the sample portfolio above, a tactical shift could be increasing the portfolio’s holdings of small-cap stocks if the Federal Reserve were to begin cutting interest rates, as historically small caps have done well when interest rates drop.

Tactical shifts are not meant to be large changes – usually they are under 10% of the total weighting. However, they do require skill to manage, so are usually best implemented in a portfolio by either a financial advisor or an automated, quantitative model.

Bottom Line

Constructing a portfolio that meets your goals and fits your risk profile requires a combination of skill, knowledge and most of all – a deep understanding of you as an investor. Your investment advisor can work with you to determine the best mix of assets for you at each stage of your life and in each phase of the business cycle. Keeping your portfolio attuned to short-term opportunities and avoiding temporary pitfalls can add significantly to your portfolio’s value.