“It takes as much energy to wish as to plan” – Eleanor Roosevelt

Owning your own home isn’t just about creating your dream of personal space – it’s one of your largest investments and can be the foundation of your financial security. But the process is complex, from saving for a down payment to getting a mortgage, is complex. We break down some of the ways you can get there more quickly, and help the purchase go more smoothly.

Key concepts we’ll cover: Setting a price range, saving your down payment in a short-term investment account, mortgage pre-approval, insurance.

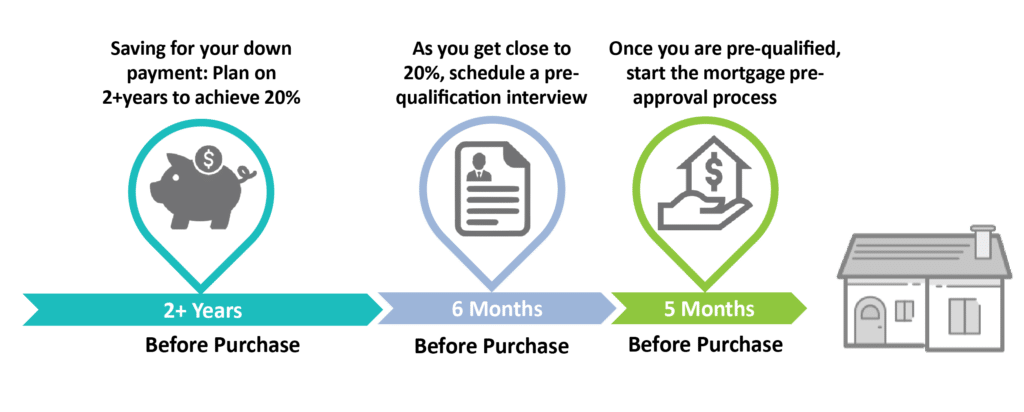

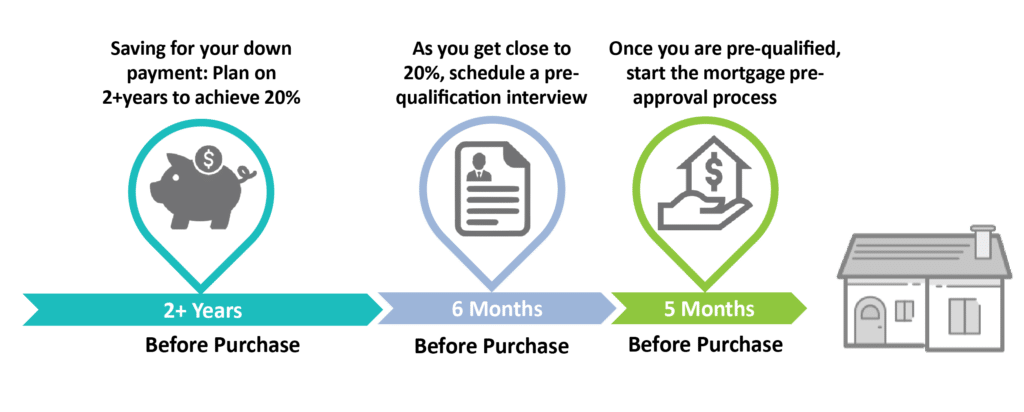

Home Buying Timeline

Set Your Price Range

A good rule of thumb is to set the top end at less than 2.5 times your annual income. But note – your price range should also include long-term expenses such as maintenance or planned upgrades.

When setting your price range, it’s also important to note the trade-offs you may have to make, including location, school district, taxes, and size. For example, if your ideal location for a home is out of your price range, look to see if surrounding neighborhoods offer a more affordable price. Prioritizing what’s most critical will help root your price range in appropriate options.

What’s the Right Size Down Payment?

Being able to put down at least 20% on a new home is extremely cost-effective. You not only save on mortgage costs, you save on the cost of mandatory private mortgage insurance (PMI), which lenders require for instances where there is less than a 20% down payment. Another advantage is that in a tight housing market where you may be competing with other buyers for your dream home, having 20% in cash may push a seller in your direction.

Saving – and Investing – Your Down Payment

Get started by reviewing your expenses and determining the maximum percentage you can save from your salary. It’s best to start with a number in mind, and then open an investment account that you add to every pay period. An investment account is important for two reasons: you want to boost the value as quickly as you can by adding investment return, not just bank interest. Also, you won’t be able to draw from an investment account the way you could from a savings account – which helps keep you on track.

Consistently contributing to a short-term investment specifically for funding your down payment, closing, and moving costs is a good way to add the potential to get to your total faster than just a regular savings account. While your retirement plan allocation may be structured for growth because of the long-term time horizon, it’s most important here to preserve capital as there is limited time to recover in the event of a market drop.

Start the Lending Process

Check your own credit report, and then start with a pre-qualification interview with a mortgage loan officer. They’ll help you understand all the things that lenders take into consideration besides income. Assuming everything looks good, your next step is to get pre-approved for a mortgage loan. Once you feel ready to start looking, go talk to your bank – or a few banks.

Go for the Gold Standard – Mortgage Pre-Approval

A mortgage pre-approval will make your realtor more comfortable and may be an advantage when it’s time to negotiate with a seller. Most importantly, getting this somewhat arduous step out of the way first may prevent potentially costly delays and disappointments.

You’ll need to put together a full financial package including proof of identity and employment, income and debt information, and savings and investments. The pre-approval doesn’t guarantee that you’ll be able to get a loan, but it does tell a seller you’re able to make a legitimate offer and have committed to making the process as quick as possible.

Review Your Insurance Coverage

Finally, in addition to your new homeowner’s insurance, if you’ve bought the house jointly with someone else, review life insurance coverage for you and your co-owner to be sure that the survivor will have a plan to cover the mortgage and tax payments.

Bottom Line

Buying a home is a huge achievement – and a very smart step to financial independence. By saving for a down payment and being careful to stay in an affordable price range, you’ll be able to create your own haven, potentially reduce your expenses, and diversify your investment portfolio.