When it’s time to retire, many investors find that saving was just the start of the retirement journey. The next phase is to invest those assets so that they provide income to live on for an entire retirement.

One of the biggest risks to a retirement plan in the drawdown phase is a period of negative returns early in retirement.

That’s when you have the most capital invested, and it has to last the longest amount of time. Early retirement is also often the period when people are drawing the highest income out of their retirement plans, as they adapt to an active new lifestyle. These pressures can significantly reduce the amount of projected retirement capital.

The effect on a portfolio of a period of negative returns in early retirement is called Sequence of Returns Risk. There are ways to mitigate it, but first it’s important to understand how it affects a portfolio.

What Is Sequence of Returns Risk?

One of the biggest risks that comes with taking distributions from a retirement portfolio is bad timing. Even with a conservative withdrawal strategy (4% per year is standard), if combined with a market downturn early in retirement, those first withdrawals could potentially negatively impact your portfolio for the duration of retirement.

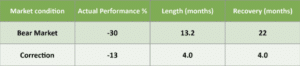

The table below lists historical average market performance during bear markets and market corrections since World War II, as well as the length of time they lasted on average and the time for a portfolio to recover to pre-drop levels.

Source: CNBC January 2018. A bear market is one in which the market drops more than 20%. A market correction is when the market drops more than 10%.

Liquidating assets when the portfolio is at a lower asset value due to negative market performance crystallizes the loss and the smaller portfolio then has a more difficult time recovering.

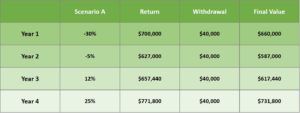

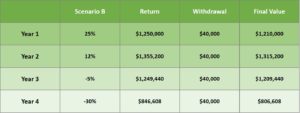

Let’s look at a hypothetical portfolio experiencing two different return environments in the first four years.

Source: Seven Group

The portfolio experienced the same returns – just in the reverse order. Over the four-year period, the portfolio that experienced the negative returns first was down almost $75,000 compared to the portfolio with the luckier return stream. That’s almost twice the withdrawals – and over time, without a very strong positive stream of returns – it could be a significant problem.

Reduce Risk Through Asset Allocation

One way to mitigate sequence risk is through proper asset allocation. Asset allocation divides an investment portfolio into different asset classes such as stocks, bonds, real estate, or cash. It can help protect against sequence risk because you’re placing portions of assets outside of the stock market and capturing a broader range of returns.

A diverse portfolio can provide different ways to generate income and returns. When the stock market is heading south, the goal of diversification is to have enough money placed in other asset classes or categories to ride out the volatility. By being invested in assets that play different roles and are not correlated with each other, you can begin to create balance in your portfolio that helps to withstand changing market conditions.

Use a Time-Bucket Strategy

Another way to help mitigate sequence of returns risk is by utilizing a time-bucket approach to retirement investing. Time-bucketing divides your assets by the timeframe in which you are likely to need them. Funds that will be needed in the immediate future, say three years or so, are primarily held in cash or other short-term investments.

This helps the portfolio to ride out a period of negative returns by avoiding the need to sell off investments in a down market. Investment horizons are generally divided into intermediate-term assets which are held in capital preservation strategies that also throw off income and long-term assets that are earmarked for growth. These longer-term assets have the longest amount of time to recover from downturns before they will be needed.

Before implementing a time-bucket strategy, it’s important to have an understanding of short-term income needs so you can appropriately allocate funds in the correct buckets. While you may miss out on some potential returns by holding years of expenses in cash, the trade-off for increased stability and peace of mind may be worth it.

Creating a Bond Ladder

Diversifying into bonds creates a less-correlated asset that can potentially perform well when the stock market is struggling. It can also provide a source of income from the yield on the bonds. However, bond markets are at the mercy of the bulls and the bears too, and they are susceptible to interest rate risk.

The goal of a bond ladder is to reduce the interest rate risk by purchasing multiple bonds with different maturities. This minimizes the possibility of the entire portfolio maturing and needing to be replaced in a period in which yields may not meet income needs. In addition, it allows for some flexibility in generating cash flow as each bond matures at a different time, and taken together can provide predictable inflows of cash.

Consider Using Home Equity

In 2020, 76% of people aged 55-64 were homeowners and that figure rises to 80% for ages 65+ (1). If you’ve paid off your home or it has increased in value, using home equity may be a viable option to avoid selling investments in a declining stock market.

For short-term needs a home equity line of credit (HELOC) can be effective because during the draw period, one is only required to repay interest. Generally, draw periods last five to ten years. In this situation, since the goal of a HELOC is to help bridge the gap in income during a down market, recovering markets and rising income can make the future principal repayments more manageable.

If you’ve always dreamed of selling your home and touring the country in an RV, you’re in luck. That passion may be an effective way to reduce risk. Even if you don’t have dreams of the road, selling your home and downsizing or renting can be effective ways to free up needed cash.

Since these strategies stray away from typical income generation, it’s important to weigh the benefits and take all factors into consideration before implementing.

The Bottom Line

Risk presents itself in every retirement plan. Having an understanding of both your risk tolerance, as well as your income needs, is crucial to effectively managing sequence risk. With the many ways to approach risk management, working with a trusted financial advisor can help remove complexity and uncertainty around your retirement strategies.

1. Source: U.S. Census Bureau, Current Population Survey/Housing Vacancy Survey, February 2, 2021. Revised based on the 2000 Census.

We Deliver Content Like This Every Month to Your Inbox. Sign Up to Start Receiving Updates

Related Posts

Tax Increases Aren’t Just About Rates

The Build Back Better Act has gotten a lot of press for the intended means to pay for it – by...

Investing in Retirement: It’s About Avoiding Volatility

You’ve been saving and investing diligently and now retirement is finally here. You may be at the...

Rock, Meet Hard Place: Inflation and Early Retirement

Retiring early requires disciplined saving and careful planning under the best macroeconomic and...