The primary role of a financial advisor is creating a diversified portfolio that has the potential to meet your long-term goals. But the most critical factor in achieving them may be to ensure that you stay on plan and remain invested for the long haul.

The benefits that accrue to the patient investor – the one who rides out market fluctuations with sanguinity – are clear in the form of increased return. But it can be very difficult to remain calm when faced with fluctuating asset values and confusing information. Both you and your advisor need to be aware that risk tolerance isn’t just a function of the standard questions asked on the questionnaire you filled out when you opened your account. It’s critical that your advisor understands the emotions inherent in investing, including your level of worry and your reaction to loss.

To get at that, we need to look at the behavioral aspects of financial planning and investing.

A behavioral finance lens can create a more nuanced understanding of your reactions when confronted with unexpected results. This can give your advisor tools to stabilize your asset allocation plan and keep you on track.

Risk Tolerance Is Influenced by External and Internal Factors

An interesting way to understand how external factors can influence behavior is to look at how Millennials invest. Advisors are finding that this age group belies the traditional age-related risk parameters – they are actually more risk-averse than all other age groups, including retired people. The reason? The global financial crisis (“GFC”) hit them as young adults and became as foundational for them as the frugality engendered by the Great Depression was for the Greatest Generation. Understanding the impact, however, also goes beyond risk-taking behavior and affects what they invest in, where and why.

That’s just one example of how surprising investor behaviors can be, and how tied they are to emotional mindsets and generational as well as individual personality traits. Behavioral finance focuses on these and attempts to help both advisors and clients recognize and correct for biases.

Surfacing and Countering Hidden Behaviors

Staying committed to an investment plan and disciplined when facing volatility can often come down to avoiding biases when they kick in. Since the risk questionnaire is filled out when you are calm and anticipating a helpful, positive financial plan, biases may be hidden. It makes sense for your advisor to also model scenarios of high market volatility when the risk of loss is greater, and then assess how you react and what your level of comfort is – and then modify the plan to accommodate you.

Understanding how you feel when confronted by the loss of a significant portion of your assets – even hypothetically, and understanding how long it takes to recover, can lead to setting up policies for different scenarios that can be followed when a crisis hits.

Understanding the Impact of Market Downturns

Warren Buffet’s net worth dropped over $20 billion dollars throughout the GFC. How much money did he lose? None – he remained invested, his positions recovered, and his net worth today is much higher.

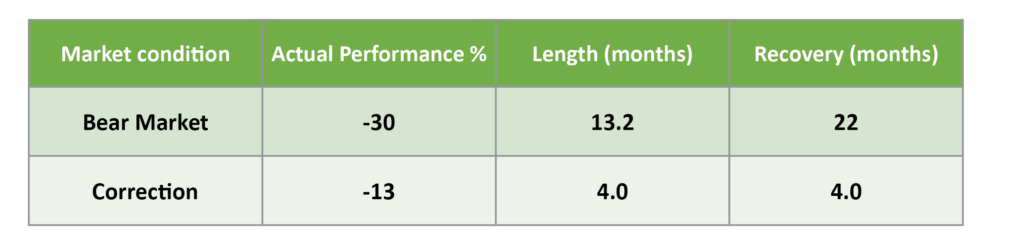

Staying the course of an asset allocation can be difficult in the face of a falling market. It’s important to understand how long such market contractions may last, and how long it may take for your portfolio to recover – before it can then begin to increase again. The table below lists historical average market performance during bear markets and market corrections since World War II, as well as the length of time they lasted on average and the time for a portfolio to recover to pre-drop levels.

Depth of Decline and Time to Recover

Source: CNBC January 2018. A bear market is one in which the market drops more than 20%. A market correction is when the market drops more than 10%.

Identifying Biases

Behavioral finance has defined several biases that you should be aware of as you work with your advisor, as they potentially may be relevant to your own investing behavior.

Anchoring describes the tendency of an investor to set their expectations – and their future judgments – around the first piece of information they receive; for instance, the initial purchase price of a security or NAV of a fund. Because of this, investors may resist selling a position that is generating losses, in hopes that it will improve enough to get back to their buy-in point. Setting a “stop-loss” at the time of investment – whether a formal order or just triggering a review – can help, as can including an annual strategy for tax-loss harvesting in the initial investment plan.

Local or Familiarity Bias is the desire to overweight assets that are more familiar, as they are perceived as having less risk and potentially higher return. These can include a bias to U.S. assets, the stock of an investor’s employer, or even just brands or products they feel loyal to. However, limiting investments to familiar assets can result in a portfolio that lacks the diversification necessary to meet a preferred risk/return profile. Strategies for overcoming local bias can include increasing comfort with non-domestic assets by selecting similar companies or sectors in an international allocation, thoroughly reviewing the risk profiles of preferred companies, and understanding the double risk incurred by holding company stock. Lehman Brothers employees faced not only the loss of their jobs, but also a significant part of their assets.

Trend or Pattern-Detection Bias reflects the very human tendency to buy on past performance, instead of on fundamentals. This is the most prevalent of all biases – to believe in the validity of a pattern, and it’s what makes it critical to look beyond performance. Countering this may involve sticking to an asset allocation, accepting that the efficiency of markets makes it likely others have already noticed this pattern, or potentially setting a plan to postpone buying until the desired asset has dropped in price by a defined percentage.

Articulating Risk Beyond the Questionnaire

Understanding your life plans and matching an asset allocation to your risk tolerance is important to the success of your future financial goals. This includes surfacing possible hidden behaviors and biases, and working with your financial advisor to plan for stressful periods and set up strategies and rules that can kick in when things get difficult. By gaining a deeper understanding of your “investing self” you may be able to comfortably remain invested through rough patches, which can help ensure you get where you want to go.

We Deliver Content Like This Every Month to Your Inbox. Sign Up to Start Receiving Updates

Related Posts

Selling your Business and Getting the Most Value

If you are counting on selling your business to create a pool of wealth to fund retirement and...

A Good Credit Score Is A Good Investment

You probably know your credit score is important, and you may even have an idea what your “number”...

Getting Divorced? There's more Options than Litigation

The most common perception of divorce is that of a long, expensive, adversarial legal process. But...