4 min read

Understanding Supplemental Executive Retirement Plans

By:

David DeWitt, CFP®

on

Jun 22, 2022

“Retirement is wonderful if you have two essentials — much to live on and much to live for.”

As you’re climbing the corporate ladder, you’ll be contributing to an employer-sponsored retirement plan. But often, if you’re a senior executive or otherwise a key employee, the amount you’re able to contribute to a qualified retirement plan, under ERISA and IRS rules, does not keep pace with your compensation. There contributions are limited, and as a percentage of salary that limit can be low.

Having a very high salary can mean that you can stash after-tax funds in a taxable account to be tapped in retirement, but the operative words there are “after-tax”. You’ll have to pay the taxes now, while you are working, and the tax liability may be a significant burden.

The Supplemental Executive Retirement Plan (SERP) can solve this dilemma. This is a non-qualified plan, so typical 401(k) restrictions don’t apply. It is a contract negotiated directly between the executive and the company and is entirely customizable to each situation. There are no limits on the value of the contract, and it can be very lucrative for the employee. How lucrative? SERPs are a common way for sports teams to compensate star players.

The Basics Principles of the SERP

To get into the technical details, SERPs are an employer-sponsored, non-qualified, deferred compensation plan. In plain English, that means the employer agrees to pay the employee a given amount of compensation in the future, and the employer is not limited by the rules of ERISA in determining who gets a SERP, how much it’s worth, and how it will be paid for.

Let’s get into the positives first. Employers offer them only to certain employees as part of an overall compensation package. There are no income limits, and there are no contribution limits. There are several different ways to fund the plans. It could be a straightforward arrangement where the company agrees to pay a lump sum or make a series of payments, starting and ending on a given date. The employer may also agree to contribute to an investment fund that will be turned over to the employee.

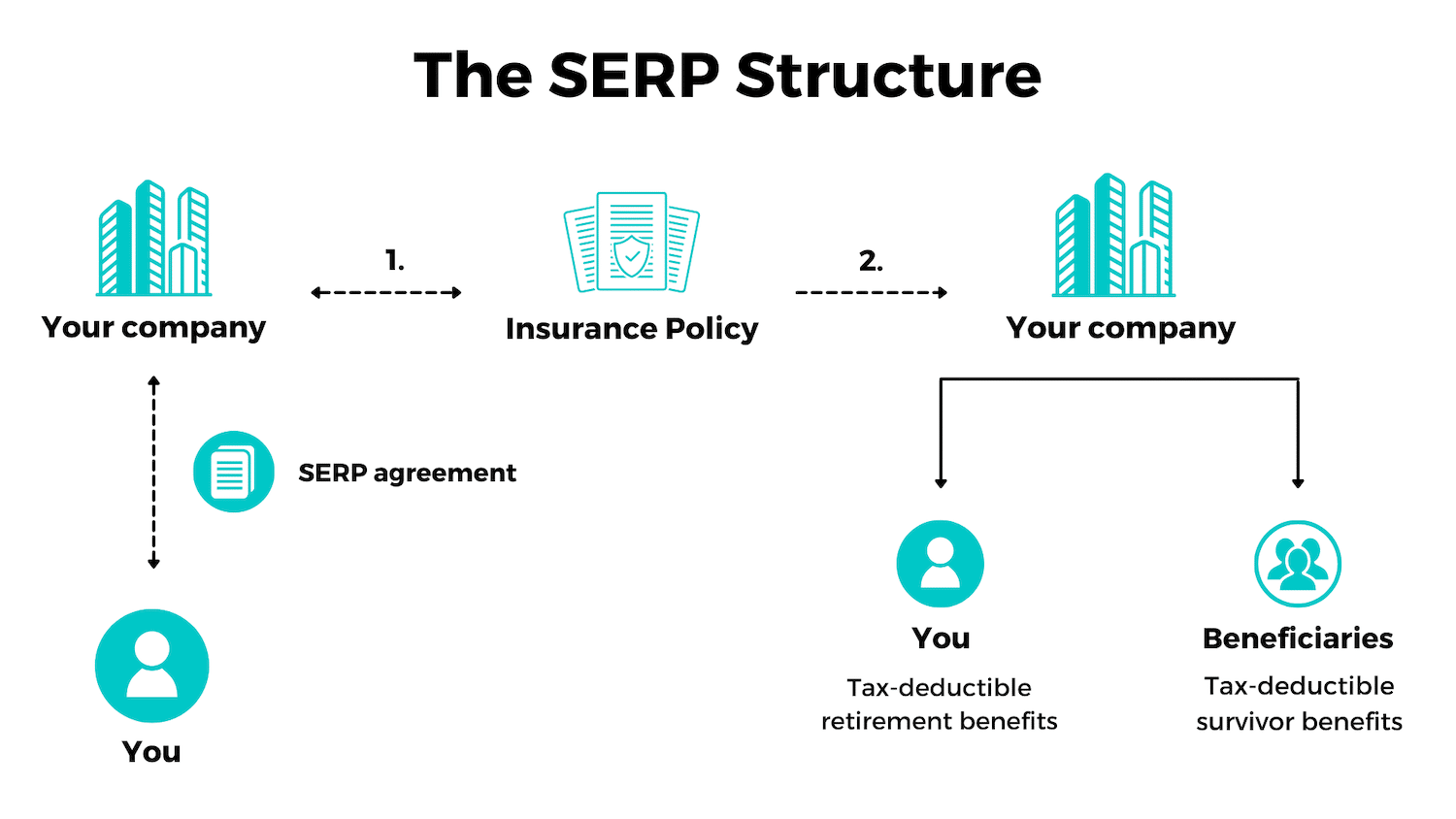

The most common option is for the employer to purchase a cash-value life insurance policy on the employee. When the employee retires, the company either transfer ownership of the policy or pays the employee benefits funded by the policy. This method is popular with employees because the cash value grows tax-deferred until the funds are received in retirement, when they are taxed as ordinary income.

The Quid Pro Quo

The employer agrees to pay the executive income in the future (typically in retirement), and the employee commits to continue working for the company for a set number of years. The two parties decide on the amount of the future income by considering a number of factors: the employee’s length of service, the company’s economic success, and the employee’s total compensation and benefits package. The continuation of employment condition is often called “golden handcuffs”.

Choosing a Formula and a Funding Strategy

The negotiations around the SERP will determine the funding formula, which will be specified in the contract. Despite being non-qualified plans, they borrow from ERISA language in determining the structures, and can be either defined contribution or defined benefit.

Defined Contribution

Under this arrangement, the company will contribute a certain amount of money each year to the employee’s SERP account (plus interest). For example, the employer funds $100,000 each year to the SERP until retirement and kicks in 4% interest annually. Then the company pays the funds to the employee upon retirement (lump sum or installments, depending on the contract).

Defined Benefit

The payout for the defined benefit method is more complex. As part of the employee’s contract, the company compensates the employee at retirement based on one of three ways.

1. A flat dollar amount such as $100,000 will be paid to the employee each year for a specific number of years, beginning at retirement.

2. The payout is based on a percentage of the executive’s salary. For example, the executive will receive half of their final salary before retiring for a decade starting at retirement.

3. The payout can be based upon a formula. For example, the retirement funds are assessed at 50% of the average of the executive’s last three years of salary before they retired.

Regardless of the benefit amount, the employer often chooses a cash-value life insurance plan to fund the payout.

Example Life-Insurance Funded SERP

Let’s assume that a Company ABC and CEO Richard agree on a SERP that will pay Richard $100,000 per year for nine years from age 61 to 70. The company purchases a life insurance policy that names the firm as the owner and policy beneficiary. When Richard retires and begins to receive his benefits at age 61, they will be taxable to him as income and tax-deductible to the company for each year that Richard gets the funds. When Richard dies, the company or his beneficiaries will receive his death benefit.

Receiving the Benefits at Retirement or Death

An event such as the employee’s demise, retirement, disability, or plan termination will activate the distribution of the SERP benefit to the employee or their beneficiaries. The benefits are either distributed in a lump sum or installments, as stipulated in the agreement.

Risks

The funds that a company sets aside for SERP in a life insurance policy for its employee are not sheltered from creditor claims against the company if the company declares bankruptcy. Also, because a SERP is a non-qualified plan, if the employer declares bankruptcy and lacks the funds to pay the SERP benefits, the employee would be regarded as a general creditor of the employer and would not be granted favored consideration when trying to recover the benefit.

Bottom Line

SERPs allow executives to accrue company-sponsored retirement funds that do not incur tax penalties until they are withdrawn in retirement. These funds do not have any of the limitations on either contributions or withdrawals of qualified retirement plans. SERPs may also offer protection for the executive’s family if something happens to them while they are still working. The trade-off is the commitment to remain with the company for a set number of years.

This is a negotiated contract and must be carefully constructed. It is part of the compensation package, and the impact on the entire financial plan must be taken into account. Getting good representation and consulting with a financial advisor can help ensure that your retirement plan investments make sense. Incorporating SERP funds into the plan is key to keeping risk, concentration limits, and growth strategies in line.

We Deliver Content Like This Every Month to Your Inbox. Sign Up to Start Receiving Updates

Related Posts

Retirement Is About Income … and Taxes

You’ve figured out your budget, your retirement nest egg is substantial, and you’re ready to make...

What you Need to Know About Stock Options

Whether you’re at a pre-IPO start-up, a growing public company, or a blue chip that just developed...

Tax Increases Aren’t Just About Rates

The Build Back Better Act has gotten a lot of press for the intended means to pay for it – by...