Feel confident about your money with financial planning that your brain can handle.

.png?width=200&height=200&name=New%20option%20(3).png)

.png?width=200&height=200&name=New%20option%20(2).png)

We proudly hold your hand through it all.

No shame in that! Working with Infocus is like installing a financial partner into your life who you don't always want to talk to, but who you know you should talk to, and are glad when you do.

- Ongoing scheduled progress check-ins and accountability

- Text your planner anytime

- Hands-on assistance and instructions setting up apps

You won't always need us, but you'll be happy you have us when you do need us.

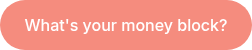

Optimize your Investments

Start investing or optimize your existing portfolios

- We manage your investments for you, so you don't have to figure it out all on your own

- We help you feel confident that you are making the right choices

- We coach you through the hard times when the market is in hyper-active mode

- We help you feel smart about money

Get your money satisfyingly organized

Close your eyes and imagine future you where you have it all together. Feels nice, right?

-

Right now, you may not feel very confident about how you're managing your money day to day

- We help you set up a system that simply works for you

- And if it doesn't work, we keep working with you until it does

- We'll help you evolve (even if it takes five years) into the financial wizard you know you can be.

We help you get all your bucks in a row

Offering ADHD-approved tools to budget, automate, invest, and more.

There is an ocean of financial tools out there. Instead of spending weeks trying to test and find the ones that work for you, you can work with us and get free access to the tools we know work from our experience working with fellow ADHDers.

Budgeting App

Access your premium budgeting app for free, with your advisor's support. It's your app and data, and we cover the cost.

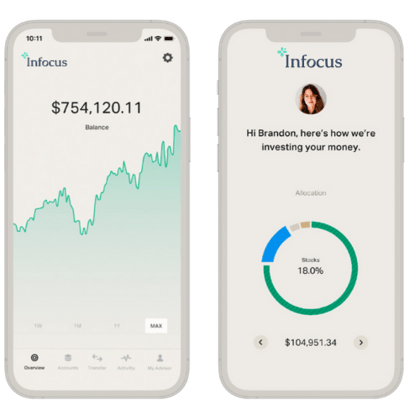

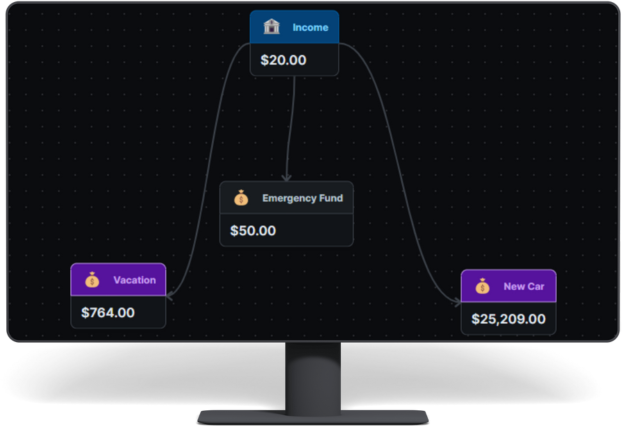

Money Automation

We help you automate your cash flow and have an arsenal of tools and services to match you with that will fit the way your brain works.

Financial Planning

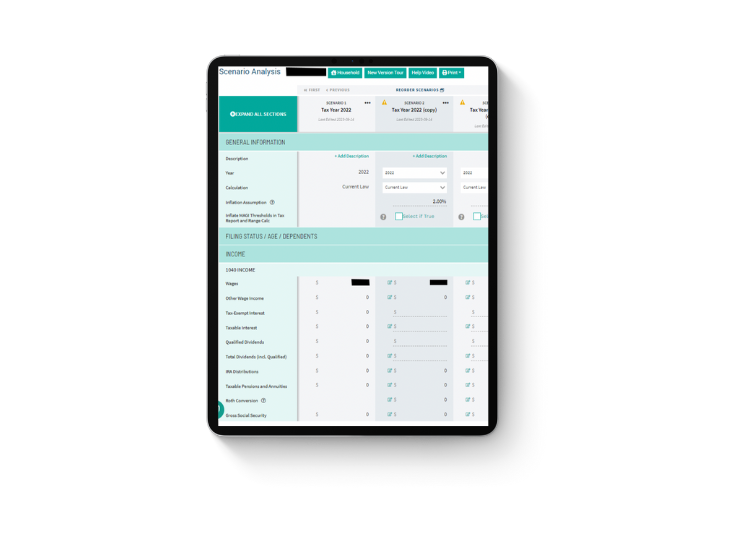

Access your financial planning account to update details, explore scenarios, and see future impacts. We'll handle creating your personalized plan.

Tax Planning

Avoid unexpected tax bills with our top-tier tax planning software, which ensures your withholdings are correct and refines strategies like Roth conversions.

Estate Planning

Creating an estate plan with a lawyer can be expensive, but our platform lets you do it for free, including future updates.

Pick Your Adventure: Ways We Can Help

Explore the ways we can serve you

- Shameless Money

- Investment Management

Money Clarity Call

(The best first step for most)

Finally Talk to Someone Who Gets It

The Money Clarity Call is a 60-minute conversation with David DeWitt, CFP® and fellow ADHD brain, where you get real answers about your financial situation and a personalized coaching roadmap designed specifically for how your brain works.

What You Walk Away With:

- Someone Who Listens - Share your story, your pain points, your goals, your fears. No judgment. No spreadsheets shoved in your face. Just a real conversation with someone who understands the ADHD money struggle.

- Clarity on What's Actually Going On - Get an honest, clear-eyed picture of your financial situation and the patterns that have been keeping you stuck.

- Your Personalized Coaching Proposal - Receive a custom roadmap tailored to your unique situation, whether your struggle is more behavior-weighted (shame, avoidance, impulsive spending) or structure-weighted (chaos, no system, money everywhere).

- A Real Next Step - Know exactly what to do next, whether you continue with coaching or decide to go it alone.

Why It Costs $197:

This isn't a free sales call. It's a paid consultation. That means David shows up fully invested in giving you value, not pressuring you into a package. You get real guidance. If coaching feels right, great. If not, you still walk away with clarity. The $197 is applied as credit toward any coaching package you choose within 30 days.

Staying stuck without guidance isn't just financially costly. It's draining you emotionally. This call is your chance to finally talk to someone who gets it and figure out what to do next.

Financial Planning

Starting at $5,400 annually ($1,350 quarterly)

The "Get Your Financial House in Order" Approach

This service focuses on creating and implementing a comprehensive financial plan over the course of a year, giving you the structure and tools to take control of your finances.

What You Get:

- Structured approach with clear milestones and deliverables

- Comprehensive financial plan tailored to your ADHD needs

- Implementation support and accountability

- Educational resources and skill-building

- Tools and systems designed for your continued success

- Defined one-year engagement with optional renewal

Perfect For: Young professionals, growing families, and DIY-minded individuals who:

- Need expert guidance setting up financial systems

- Want a clear structure and timeline for implementation

- Prefer to manage their own investments after receiving guidance

- Aren't looking for an indefinite relationship

- Value learning and building financial skills for independent management

Investment Management

1% of Assets Under Management (minimum investment: $250,000)

The "Financial Partner for Life" Approach

This service is designed for those who want to delegate their financial management and establish a long-term relationship with a trusted advisor who understands ADHD challenges.

What You Get:

- Comprehensive financial planning woven into our ongoing relationship

- Professional investment management with tax-efficient strategies

- Adaptive, flexible approach with no rigid timeline

- Regular check-ins and support at your pace

- Access to our full suite of ADHD-friendly tools and resources

- Continuous guidance as your life and financial needs evolve

Perfect For: Established professionals, business owners, and successful individuals who:

- Have accumulated significant assets ($250,000+)

- Want to delegate financial management to a trusted partner

- Prefer an "installed financial brain" in their life for the long-term

- Value flexibility and adaptive support over rigid structures

- Seek a comprehensive relationship that evolves with their life

Hybrid Approach

Custom fee structure combining planning fees and asset management

The "Grow With Us" Approach

This service combines aspects of both planning and investment management, designed for those who want comprehensive support as they build their wealth.

What You Get:

- Long-term partnership approach like our Investment Management service

- Professional management of your current investment assets

- Comprehensive financial planning integrated throughout

- Growth-focused strategies and accountability

- Streamlined fee structure with part paid from investments and part from cash flow

- Flexibility to transition to full Investment Management as assets grow

Perfect For: Growing professionals, entrepreneurs, and wealth builders who:

- Have some investable assets but haven't yet reached $250,000

- Want a long-term financial partner to guide their wealth journey

- Value both planning guidance and investment expertise

- Are actively focused on growing their wealth

- Seek a relationship that will evolve as their financial situation matures

What can you expect?

We understand that ADHD requires a different kind of support.

step 1

Introductory Call

A 30-minute conversation where we get to know each other, discuss your financial situation and goals, and determine if we're a good fit for working together.

step 2

Get up and running

Regardless of which service you choose, we'll start with diving deep to understand what matters to you, gather your financial data, get you set up on systems and software, and create your personalized roadmap.

step 3

Ongoing Service & Support

Support tailored to your service model, with all clients receiving our signature ADHD-friendly approach: regular check-ins, body-doubling sessions, and strategies that work with your brain, not against it.

Work With us If:

· You're a high-earning professional or entrepreneur aiming to build long-term wealth (not just chase trends)

· Your ADHD brain wants a proactive partner who can handle all the heavy lifting and keep you informed

· You value collaboration and appreciate a team approach

· Family matters: you want to protect your kids' future and set them up for success

We Might Not Be A Fit If:

· You're only looking for transaction-based advice or a low-cost approach with no ongoing partnership.

· You need intensive tax prep, legal consultation, or insurance policies (we can connect you to experts, but we don't handle these in house)

· You want to day trade or trade on speculation without a disciplined, long-term plan.

· You see financial planning as a one-time quick fix, not an ongoing relationship

Someone who "Get's It"

Meet Your Guide

As a CFP®, you'd think money's a breeze for me.

As a Certified Financial Planner™ with ADHD, I understand the challenges of managing finances with a neurodivergent brain. At InFocus Wealth Strategies, I use my investment expertise and personal experience to create systems that align with our unique thought patterns. I'm dedicated to helping high-achieving professionals improve their wealth management by leveraging strengths and addressing challenges.

Newsletter sign up and eBook Download

A bi-weekly-ish newsletter for ADHDers who are ready to improve their finances.

Latest from MVP Money Moves

Fresh investment, retirement, and ADHD-friendly money strategies

Loading latest posts...