we're glad you're here.

ADHD Money Management

Spend Mindfully · Invest Intentionally · Protect Tomorrow

You're making good money, but have no idea where it goes. You know it is time to make a change. You're not sure how to start, but you're clear on the finish line: feeling awesome about your finances. It's time to team up with a financial pro who gets ADHD and can help take that weight off your shoulders, steering you towards a brighter financial future.

The InFocus Client Journey

Non-judgemental, Supportive, Collaborative, Helpful, Engaging, Caring, Knowledgable

Laying the Financial Foundation

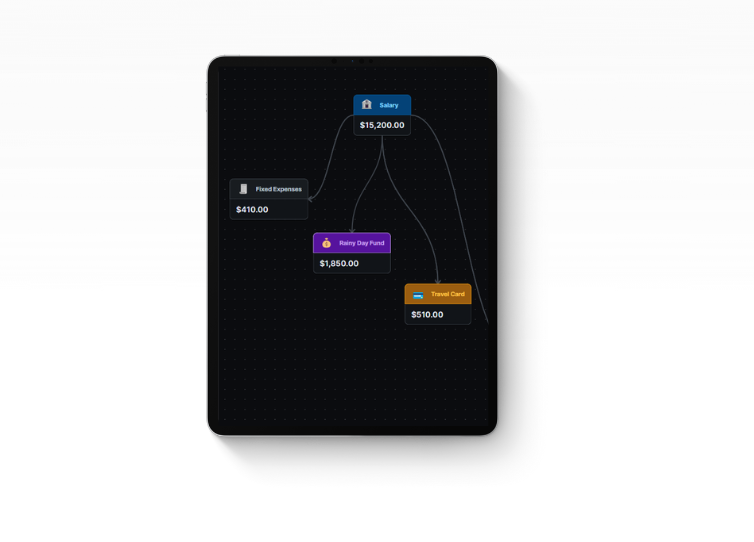

Like a sturdy house rests on a firm foundation, a secure financial future is built on budgeting, managing debt, and saving. Good financial habits, consistent routines, and a positive money mindset are key to maintaining it.- Get Organized, Gain Clarity: Achieve clarity and organization in your finances, understanding your spending and financial status.

- Budgeting & Automated Cash Flow: Enjoy the freedom of a values-aligned budget and automated cash management.

- Debt Pay-Off Plan: Create an automated, tailored debt elimination plan with visual features to keep you motivated.

- Personalized Financial Blueprint: As your financial foundation solidifies, we'll provide a blueprint to grow, sustain, and safeguard your wealth and loved ones.

Building your Investment Framework

- Investment Management: We'll craft a tailored investment plan that reflects your unique personality, risk tolerance, and goals. We'll be by your side educating, answering questions, and supporting you through the process.

- 401(k) Plan Optimization: For many, the 401(k) is their biggest asset but often neglected. We'll actively manage your employer-sponsored account, ensuring it gets the attention it deserves.

- Tax Planning: Tax planning involves strategies to minimize taxes immediately and long-term, essential for maximizing income and savings. It ensures you pay only what's necessary, boosting your financial goals.

Securing your financial structure

With your wealth-building engine active, we'll secure measures to protect your wealth, legacy, and loved ones, ensuring your financial house stands strong. And let's be real, these are the important things we ADHDers love to "get to one day!"

- Insurance planning: For ADHD individuals, disability and life insurance are crucial, offering a financial safeguard for you and your loved ones against unforeseen challenges. This safety net ensures stability and peace of mind, letting you concentrate on your goals without the stress of "what ifs."

- Estate Planning: Estate planning ensures your wishes are honored and loved ones protected, but ADHD-related procrastination and organizational challenges may cause delays, risking unintended outcomes. We'll make sure you get it done.

On-Going Support & Accountability

Managing money with ADHD can be daunting, but you're not on this journey alone. We guide you through life's transitions, ensuring your financial strategy evolves with you. More than offering advice, we ensure you remain focused and on track with your goals through accountability. Whether it's career changes or expanding families, we're here to adjust your financial plan, helping you navigate every challenge with a strategy that matches the dynamism of your life.

- Regularly scheduled accountability, body double, and review meetings

- Annual financial plan update

- Personalized annual financial checklist and calendar

- Chat and email support when you need it

Why we're different from typical planners

The ADHD Difference

-

ADHD Experience

You'll work with a financial planner who either has ADHD or who has experience working with ADHD individuals.

-

Accountability

You can rest assured knowing that a scheduled meeting to review your progress, work out your budget, or simply tackle things you have been putting off is just around the corner.

-

Coaching Approach

For most people, money is 20% numbers and 80% emotions. For us ADHDers, it's more like 20% numbers, 20% executive dysfunction, and 80% emotions. And that adds up to 120% chaos 😅 We integrate the "numbers" planning with a coaching and therapeutic approach to give you the support needed to make measurable progress toward your goals.

-

Goal-Focused Process

We keep you focused on the little goals that support the big goals that feel a million miles away. Before you know it, you'll be feeling confident and on track to the goals that may feel unreachable now.

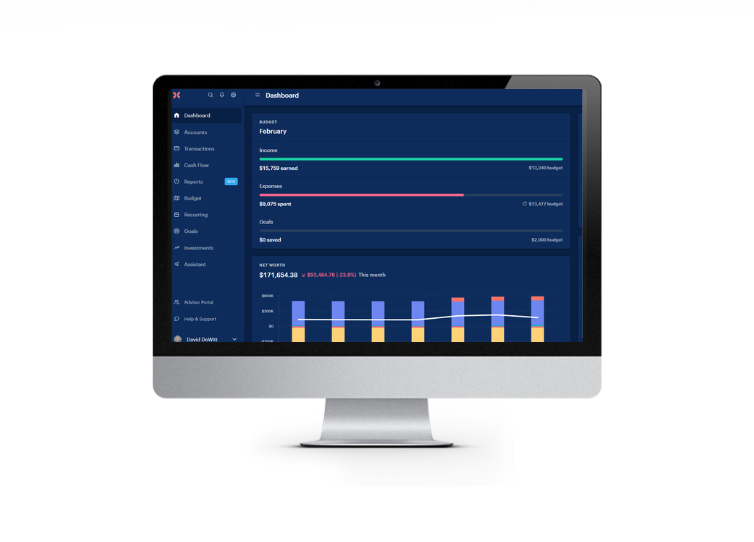

WHAT SETS US APART?

A different way for ADHDers

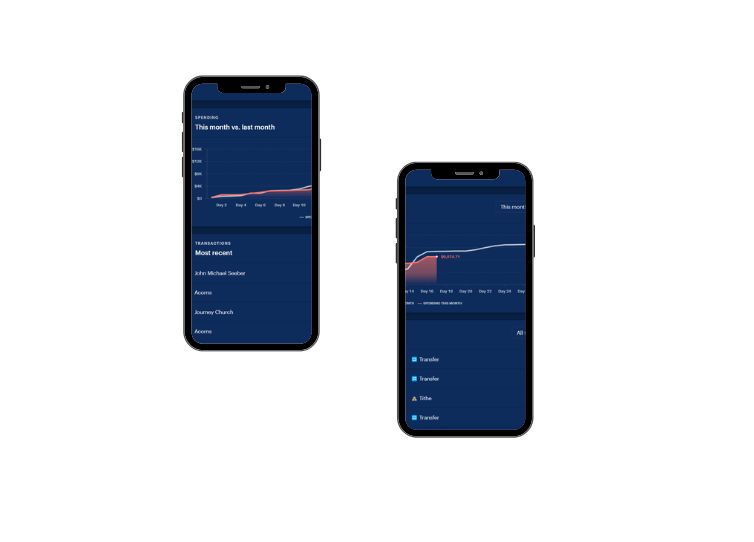

Harness the power of software to empower yourself and never feel overwhelmed or left behind again.

If you struggle with ADHD, you know that paperwork can be a major source of disorganization in your life. We will take the time to walk you through establishing a system that is tailored to your needs and works for you.

Automate

Deliver engaging presentations by switching between a bird’s eye view and a screen-by-screen prototype of your user experience. Navigate smoothly with useful keyboard shortcuts.

Prioritize

To overcome difficulties completing tasks and feeling overwhelmed by large projects, we help you prioritize by breaking tasks into smaller steps, helping you to stay on schedule and accomplish your financial goals.

On-the-Go

Deliver engaging presentations by switching between a bird’s eye view and a screen-by-screen prototype of your user experience. Navigate smoothly with useful keyboard shortcuts.

Delve further

Tailored Services

One-of-a-kind ADHD-focused financial planning with a coaching approach

A haven for financial planning, a place where you can build a solid foundation for your future. With a focus on higher-end financial planning, investment strategies, and retirement planning, we offer a variety of tailored services that resonate with you. Discover the link that speaks to your needs and interests – the one you've been searching for.

Someone who "Get's It"

Meet David

As a CFP®, you'd think money's a breeze for me.

But honestly, even with the know-how, it's still difficult and requires constant work. Normally, makaging finances is 80% emotions, and 20% knowledge. But with ADHD, it feels more like an overwhelming 99% emotions and 20% knowledge. This blend might defy math, but it's the real struggle we face, and it's important to acknowledge that.

.png?width=200&height=200&name=New%20option%20(3).png)

.png?width=200&height=200&name=New%20option%20(2).png)

Interested?

Request your ADHD Discovery Session

Looking forward to hearing from you

Fill out any information that you think would be helpful to me before our next meeting.

More than just traditional financial planning

Specialized Support

One-of-a-kind ADHD-focused financial planning with a coaching approach

-

Hands on Support

Lorem ipsum dolor amet aesthetic photo booth activated charcoal occupy iPhone schlitz squid. Everyday carry 3 wolf moon raw denim semiotics pok pok tattooed readymade bushwick. Humblebrag skateboard green juice mixtape polaroid ethical, messenger bag pitchfork sriracha hammock. Fam twee 3 wolf moon, authentic woke stumptown bespoke.

-

Accountability you can Trust

Lorem ipsum dolor amet aesthetic photo booth activated charcoal occupy iPhone schlitz squid. Everyday carry 3 wolf moon raw denim semiotics pok pok tattooed readymade bushwick. Humblebrag skateboard green juice mixtape polaroid ethical, messenger bag pitchfork sriracha hammock. Fam twee 3 wolf moon, authentic woke stumptown bespoke.

-

Go at your own Pace

Lorem ipsum dolor amet aesthetic photo booth activated charcoal occupy iPhone schlitz squid. Everyday carry 3 wolf moon raw denim semiotics pok pok tattooed readymade bushwick. Humblebrag skateboard green juice mixtape polaroid ethical, messenger bag pitchfork sriracha hammock. Fam twee 3 wolf moon, authentic woke stumptown bespoke.

-

Shared Task Portal

Lorem ipsum dolor amet aesthetic photo booth activated charcoal occupy iPhone schlitz squid. Everyday carry 3 wolf moon raw denim semiotics pok pok tattooed readymade bushwick. Humblebrag skateboard green juice mixtape polaroid ethical, messenger bag pitchfork sriracha hammock. Fam twee 3 wolf moon, authentic woke stumptown bespoke.