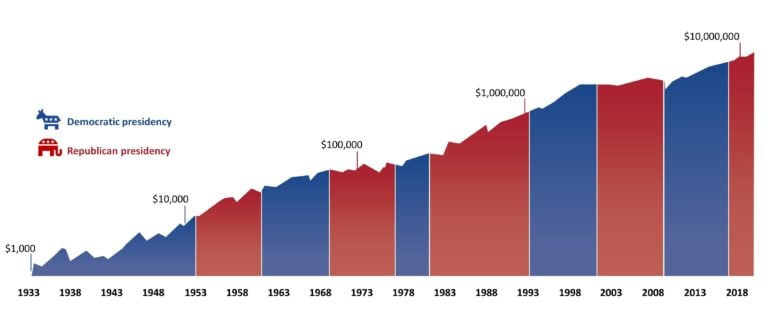

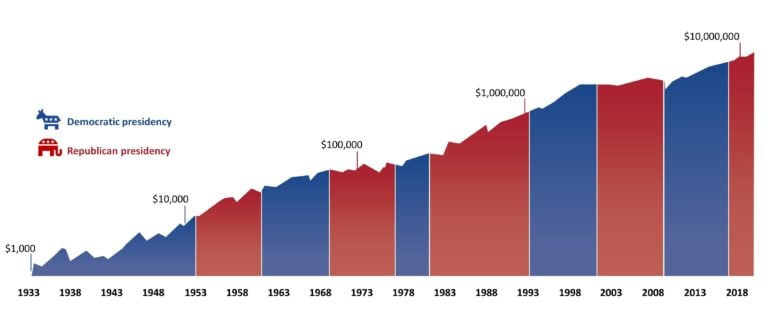

There is a way to bet on the outcome of the election – but the stock market isn’t it. For many investors, the uncertainty of an election season can create either anxiety about remaining invested, or a desire to somehow capitalize on perceived upcoming changes. But the data shows, whether the president is a Democrat or a Republican doesn’t matter that much over a long-term investment horizon.

Growth of A Hypothetical $1,000 Investment in the S&P 500

Where Does This Leave Us?

It leaves us in a bit of a waiting game. If there is a change in regime, there will likely be policy changes that are bound to create short term

headwinds in the market, but the bigger watch out is what’s happening with the ongoing pandemic - people getting back to work, vaccine

progress, and the economy continuing to open back up. Change brings opportunity. As the world adapts to the virus, entrepreneurs will continue

to experiment, new ways of working will take hold, and businesses will evolve.

What Can You Do About It?

It’s pretty simple: Have a plan and stay the course. If you’ve already worked closely with a financial advisor to set up a plan to reach your longterm goals, you’ve pretty much got this covered. If you haven’t, now is a great time to put one place. The key to the chart above are the words

“long-term investor”. Elections happen every four years – you’re going to see a lot of them over your financial journey. Investing is just as much

controlling emotion as it is setting goals, building a portfolio that maps to your goals, and playing the long game.