Everybody seems to be trying to figure out this equity market by looking at what happened in the past. And then every month, the market just blows past history on its way to new heights. We’ve tried to corral some more interesting thinking about why a historical standard might not be the right measure. Spoiler Alert: Preparing your portfolio for volatility makes good sense.

Valuations Are Too High

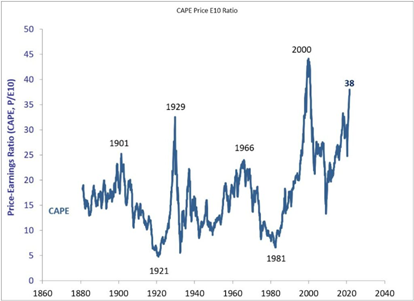

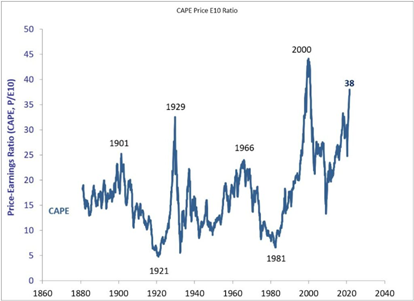

Let’s start with a chart to set the scene. Valuations have hit historic highs. The recognizable dates on the spikes on the chart below are the crash of ’29 and the dot-com bubble of 2000. The “38” label on the peak – where we are right now – is the Schiller Cape ratio. The salient fact is that it’s at 38 now and it was at 44 in 1999.

What does that mean? Well, without context, it would be scary. But the reality is that valuations aren’t just moving up on unfounded enthusiasm, like in 1929 and 1999. The shortest recession on record started in March of 2020 and was over in April. Massive liquidity from the Fed and several rounds of government stimulus did their work. GDP is consistently outpacing projections.

Earnings in the first quarter set records, and the received wisdom was that the second-quarter earnings would be the second-highest quarter on record. Guess what? They blew right through that. Earnings are real; companies are recovering. It’s driving up stock prices. Stocks have risen 20% this year, and earnings growth has outpaced the market, which has resulted in the price-to-earnings multiple on the S&P 500 contracting.

What About Interest Rates and Fed Support?

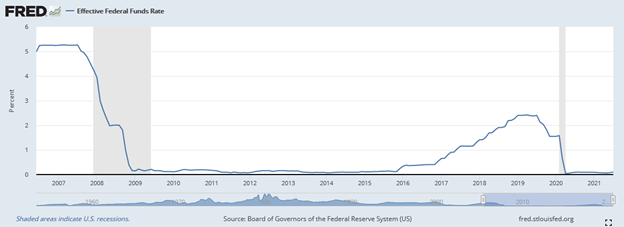

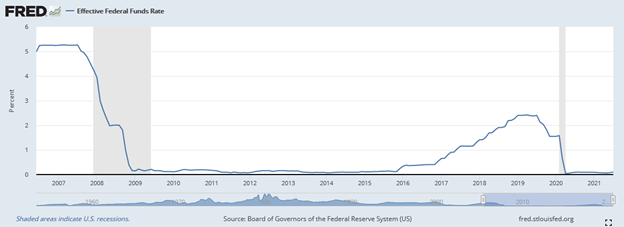

Remember how the Fed used to speak? Obfuscation was the norm. And when the Fed zigged instead of the expected zag? Chaos, tumult, and plummeting markets. It’s evolved. Chairman Powell could not be more clear. Monetary policy is hanging loose, and rates will stay low. A little blip in June, in which the dot plot hinted at a more hawkish stance resulted in the Fed clarifying (again) its position that inflation will be “transitory,” and that unemployment is the primary concern.

The Fed has stated that the focus is economic inequality and that employment reaching pre-pandemic levels – and exceeding them – is a priority. For perspective, here’s a chart of the Fed Funds rate starting in 2006. In over ten years of recovery after the Global Financial Crisis, the Fed Funds rate never got over 2.5%.

The other impact of a low Fed funds rate? The Treasury isn’t struggling to refinance the deficit. Which is a good thing because it looks like infrastructure spending might happen. But that’s another blog post.

Reasons to be Cautious?

Of course. The biggest risk we see is that investor expectations are ahead of the economic reality. Margin debt is at historic levels. Take a look at the chart below. It shows that margin debt is near all-time highs, but has actually ticked down. Is it the start of an unwinding? As you can see in the previous margin debt peaks, each time it began to come down, the market corrected and a recession followed. Also, notice the magnitude of the difference between the S&P 500 and the margin debt relative to the previous time periods. Granted, it is unlikely we are going to see a recession, but what happens next? This is a unique situation, and caution is warranted.

Remember, a good outlook on the economy does not always mean the stock market has a great outlook. With the market trading at such elevated valuations, many will argue that the good news is already priced in.

So what if the Delta variant causes growth the be slower than investors expect? But inflation keeps moving higher? What if the Fed announces they are going to taper this fall? The setup is certainly making it look likely that volatility will be with us for some time ahead.

What Should Investors Do?

Regardless of how rosy, or not rosy, the picture is, there is going to be volatility. Suppose you have a concentrated stock position or other portfolio constraints; in that case, it’s even more important to pay attention to risk, identify opportunities, and above all, structure a portfolio that you can stay invested in. This could be a historic opportunity, and what matters most does have a historical precedent – it’s more important to avoid the downs than to capture the ups. We believe that the past is a prologue, but we focus on past risk, not past return.

The Bottom Line

We’re clearly in a moment unlike any other, no matter how long you’ve been in the market. We’ve already seen historic stimulus, massive strengthening of consumer balance sheets, and a labor market with legs. And that’s just the beginning. But capturing that in your portfolio and putting it to work for your financial goals isn’t one-size-fits-all. Wherever you are in your financial journey, carefully matching your investments to your goals is critical.