You need an ADHD-Specific Financial Plan!

I know. You have ADHD, and I'm telling you to have a plan. Jokes on me, right? And I get it. Because your glorious brain works the way it does,...

I'm going to come right out and say it. Like forks and an outlet, credit cards and ADHD are two things that do not go together. Having ADHD makes you vulnerable to abuse them because they are designed to tempt you. That’s right. The system is rigged, and they (the banks) are counting on you to get sucked in. And they are good at the game! Like a drug dealer, banks know exactly what to offer with incentives like:

All-in-one easy application! Or, even better, offered at checkout at your favorite store. Saving 25% on that purchase that was questionable in the first place? Seems like a no-brainer.

You will have no interest when you pay it off, which you have every intention of doing as soon as you get home. But then you remember that you just saved $225 at Target, and you are going to find somewhere to spend that money. Because you have ADHD, something shiny will probably distract you before you pay off that bill.

The only way credit cards work is if you pay them off every month. Every single card. Can’t do this? Welcome to the club.

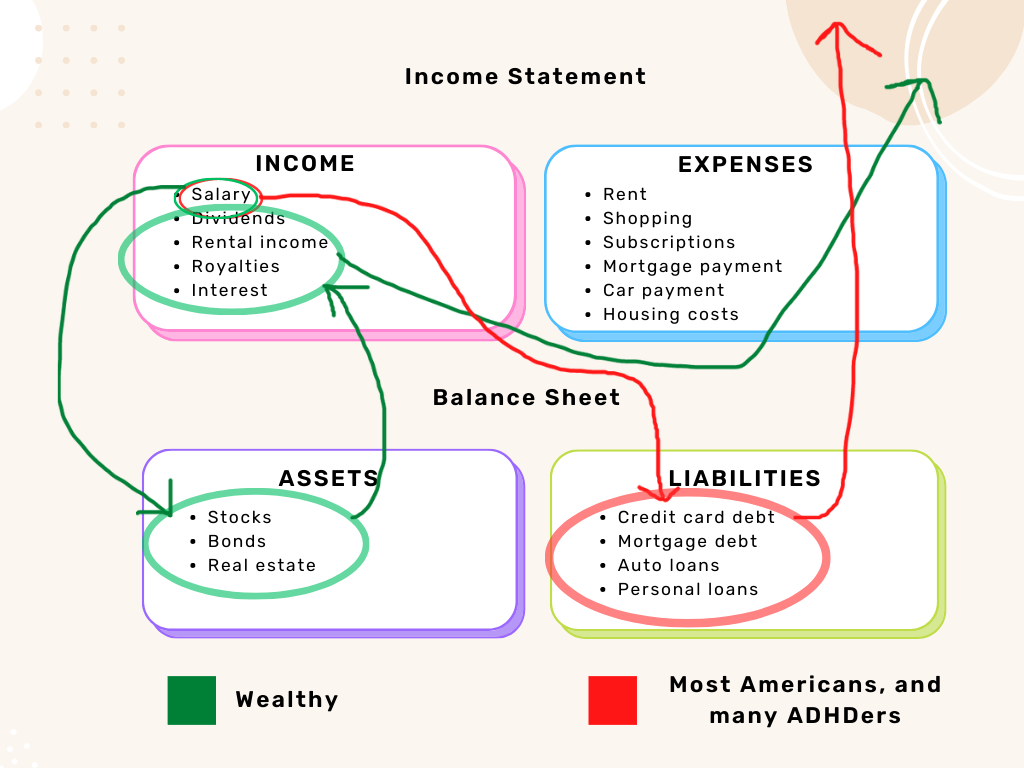

The average American is $90,000 in debt, 1and we are convinced that this is normal. But debt is not a natural part of life. And it is literally bad for your health. People who have debt are more likely to experience:

They also have perceived stress levels 11.7% higher than average2. Feeling this way is not normal.

The Bible even talks about debt. Proverbs 22:7 says that “The rich rules over the poor, and the borrower is slave of the lender.”

When you have debt, you are a slave to the banks. Debt:

I’m here to show you how to take back control, and how to live a life where your money moves you towards your ultimate ‘Why’. (Don’t know what that is? Check out my free ebook, this blog, or this podcast.) It’s time for you to be free of financial slavery.

My favorite path to freedom?

There are a lot of methods for paying down debt. Because we have ADHD, this is my favorite way. The premise? Pay off your lowest debt first. Small successes build momentum!

Get it? You start small and gradually work your way up. A snowball, rolling down a hill.

This method is helpful with ADHD because you don’t have to wait long to see your success. Momentum is key!

Sounds simple? It is. The tricky part is that you have to stop incurring debt for this to work. That’s right. No more mileage cards. Or Target cards. Or low-interest-rate cards. Take a deep dive into why you incurred debt in the first place. Check your money mindset. Remember your ‘Why’.

And take action.

Get creative. When you find a loophole, close it.

The most important thing? Be gentle with yourself and don’t give up. Turn it into a game. Celebrate the successes; from the smallest paid off card all the way to the end.

You’ve got this.

Sign up for my free newsletter and receive my ADHD Money Mastery Ebook here!

Check out my podcast here.

Schedule a discovery session here.

Follow me on Instagram here

-2.png)

I know. You have ADHD, and I'm telling you to have a plan. Jokes on me, right? And I get it. Because your glorious brain works the way it does,...

1 min read

Society seems to teach us to go to school to get good grades so that we can go to a good college and get a good job. Now we can make money to become...

Hello, folks! David DeWitt, CFP® here, reminding you that it's the most wonderful time of the year—no, not Christmas—open enrollment season! 🍁

-2.png)

Skip to the main content. About Our Services Success Stories Value of planning Client Experience FAQs ...

Skip to the main content. About Our Services Success Stories Value of planning Client Experience FAQs ...

1 min read

Skip to the main content. About Our Services Success Stories Value of planning Client Experience FAQs ...

Natasha Morris

I'm $102,000 dollars in debt and feel like I cant stop spending or get out.